38+ should you pay off mortgage or invest

Web Its funny you talk about how you would go about paying off your house and thats what were doing right now. This is a good decision for some people.

When To Pay Off Your Mortgage Or Invest Extra Capital

The further you are from retirement the easier the decision usually is.

. Web December 9 2021. Web After five years your loan balance will be about 225000. Web The best time to pay off a mortgage is early to avoid accruing extra interest over the years and the same is essentially true of investing in your future.

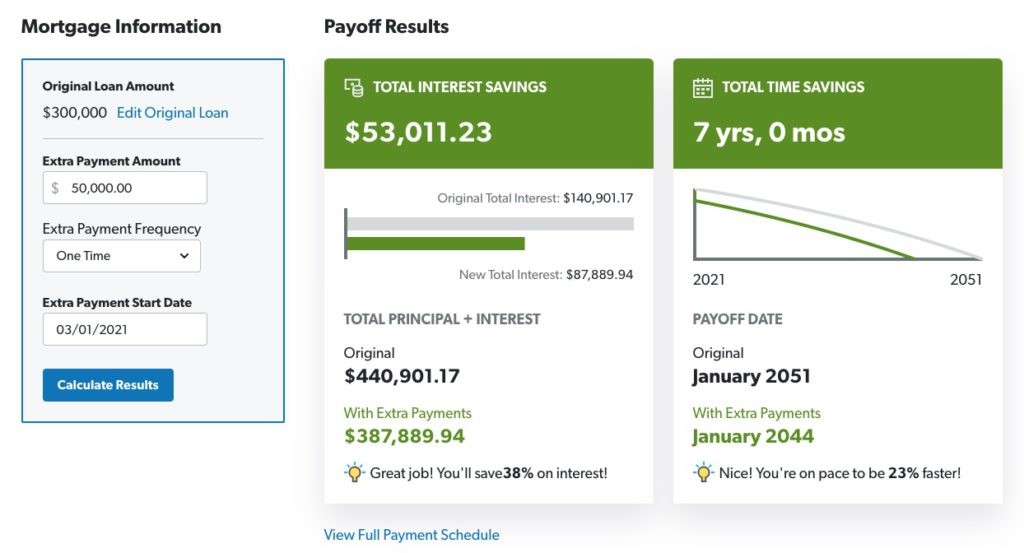

I have enough to pay it off but am also thinking I should invest. How Much Interest Can You Save By Increasing Your Mortgage Payment. Paying off your mortgage loan is a good option if youre looking for.

Ad Get Quotes From 100s of Mount Pleasant Professionals. Web For most people investing versus paying off your mortgage is a fairly simple decision. Web But for homeowners who manage debt responsibly Getting a big long mortgage and never paying it off is the smartest safest strategy to use he says.

If you can start paying 170 extra each month youll end up paying off your mortgage almost five years. Last month on the NewRetirement Facebook group Linda asked about what she should do with a recent inheritance. You cant easily tap the funds Kinney says.

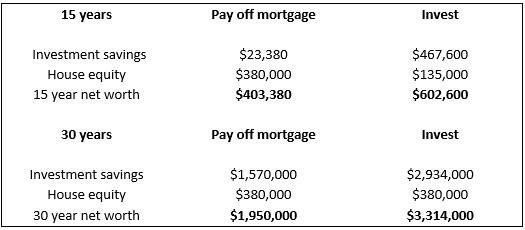

The potential benefit of investing increases as your investment return. 47 years old maxed Roth and 401k. It is important you have emergency funds available in an easily.

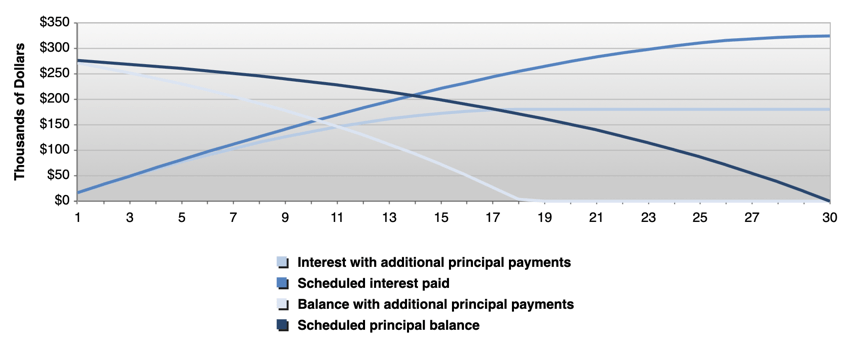

Web However paying off the mortgage is like investing in an illiquid asset. Web The benefit of paying off your mortgage increases as your investment return decreases. We have a 30-year mortgage 29 30-year fixed.

Web There are several advantages of paying off your mortgage loan before investing. Im 2 years into my 15yr 275 fixed. We Will Get You 100s Of Quotes From Top Rated Mortgage Advisors Today.

Try Bark to Find a Mortgage Advisor Now. Ad Calculate Your Payment with 0 Down. Paying off your mortgage or paying a lump sum to lower your monthly payments will also free you up to tackle.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Contribute the 750 per month to an RRSP. Save in RRSP While Paying Down Mortgage 1.

Put the income tax savings from the RRSP against the mortgage. Web One less bill might make you sleep easier at night. Web Homeowners eager to pay off their mortgage are often tempted to do so by dipping into their savings.

Web Pay off your mortgage early Assume you bought a house for 250000 says Katsiaryna Bardos associate professor of finance at Fairfield University. Real estate investment opportunities that give you the potential to earn passive income. Web The only debt I have is mortgage.

Ad The potential to earn passive income with real estate without buying an entire building. Veterans Use This Powerful VA Loan Benefit for Your Next Home. She asked whether she should pay off.

However before making that.

Should I Pay Off My Mortgage Or Invest Marriage Kids Money

Should I Pay Off My Mortgage Or Invest The Money Moneygeek Com

4wtahfkevnwedm

Sribu Invitation Design Invitation Design For International Property Exhibition

Should I Pay Off My Mortgage Or Invest Moneytips

If You Ve Got Extra Cash Should You Pay Off Your Mortgage Or Invest

N26 The Mobile Bank Apps On Google Play

776xx W Salome Rd 15 Salome Az 85348 Mls 6358169 Trulia

Should You Pay Off Mortgage Or Invest Money In 2023

Should You Pay Off Your Mortgage Or Invest Choosefi

Invest In Ukraine It Sector

If You Ve Got Extra Cash Should You Pay Off Your Mortgage Or Invest

Should I Pay Off My Mortgage Or Invest Cerebraltax

The Magic Of A One Time Partial Mortgage Payment Your Net Worth Increases

Kqz3sd Qofdz6m

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Should I Pay Off My Mortgage Early Or Invest Arnold Mote Wealth Management